if net fixed assets increased by $28,000 during the year, what was the addition to nwc

What is Internet Working Majuscule?

Just put, Net Working Capital (NWC) is the divergence between a company's electric current avails and electric current liabilities on its balance sheet . It is a measure out of a visitor's liquidity and its ability to come across brusk-term obligations, every bit well as fund operations of the business. The ideal position is to have more current assets than electric current liabilities and thus accept a positive net working capital residuum.

Different approaches to calculating NWC mayexclude greenbacks and debt (current portion only), oronly include accounts receivable, inventory, and accounts payable.

Image: CFI'south Financial Analysis Fundamentals Grade.

Cyberspace Working Capital Formula

There are a few different methods for calculating cyberspace working majuscule, depending on what an analyst wants to include or exclude from the value.

Formula:

Net Working Majuscule = Current Assets – Current Liabilities

or,

Formula:

Cyberspace Working Capital = Current Avails (less cash) – Current Liabilities (less debt)

or,

NWC = Accounts Receivable + Inventory – Accounts Payable

The first formula above is the broadest (as it includes all accounts), the second formula is more than narrow, and the final formula is the most narrow (equally it merely includes three accounts). Acquire more than in CFI'south Fiscal Analyst Grooming Program .

Download the Gratuitous Template

Enter your name and e-mail in the class below and download the free template at present!

Net Working Uppercase Template

Download the free Excel template now to advance your finance knowledge!

Setting up a Net Working Capital Schedule

Below are the steps an annotator would take to forecast NWC using a schedule in Excel.

Step one

At the very elevation of the working capital schedule, reference sales and cost of goods sold from the income argument for all relevant periods. These will exist used later to calculate drivers to forecast the working capital accounts.

Pace 2

Under sales and cost of goods sold , lay out the relevant residue canvas accounts. Separate current avails and current liabilities into two sections. Remember to exclude greenbacks under current avails and to exclude any current portions of debt from current liabilities. For clarity and consistency, lay out the accounts in the gild they announced in the balance sail.

Step 3

Create subtotals for total non-cash current assets and total non-debt current liabilities . Subtract the latter from the onetime to create a terminal full for net working upper-case letter. If the following will be valuable, create another line to summate the increment or decrease of net working capital in the current period from the previous flow.

Step 4

Populate the schedule with historical information, either past referencing the respective data in the balance sheet or by inputting hardcoded data into the cyberspace working capital schedule. If a balance sheet has been prepared with future forecasted periods already bachelor, populate the schedule with forecast data too past referencing the balance sheet.

Footstep 5

If future periods for the current accounts are not available, create a department to outline the drivers and assumptions for the main assets. Use the historical data to calculate drivers and assumptions for time to come periods. Come across the table below for common drivers used in calculating specific line items. Finally, apply the prepared drivers and assumptions to summate time to come values for the line items.

Video Explanation of Net Working Capital

Beneath is a curt video explaining how the operating activities of a concern touch the working capital accounts, which are then used to determine a company'south NWC.

Common Drivers Used for Internet Working Majuscule Accounts

Below is a list of assumptions that are used in a fiscal model to forecast NWC:

- Accounts Receivables : Accounts Receivable Days

- Inventory : Inventory Days

- Other Current Assets: Per centum of sales, growth percentage, fixed amount, or increasing corporeality

- Accounts payable: Accounts Payable Days

- Other electric current liabilities: Percentage of sales, growth pct, stock-still corporeality, increasing amount

Accounts receivable days, inventory days, and accounts payable days all rely on sales or cost of goods sold to calculate. If either sales or COGS is unavailable, the "days" metrics cannot be calculated. When this happens, it may exist easier to calculate accounts receivables, inventory, and accounts payables by analyzing the by trend and estimating a future value.

Use of Net Working Capital in Financial Modeling

Changes in net working uppercase impact cash menstruum in fiscal modeling .

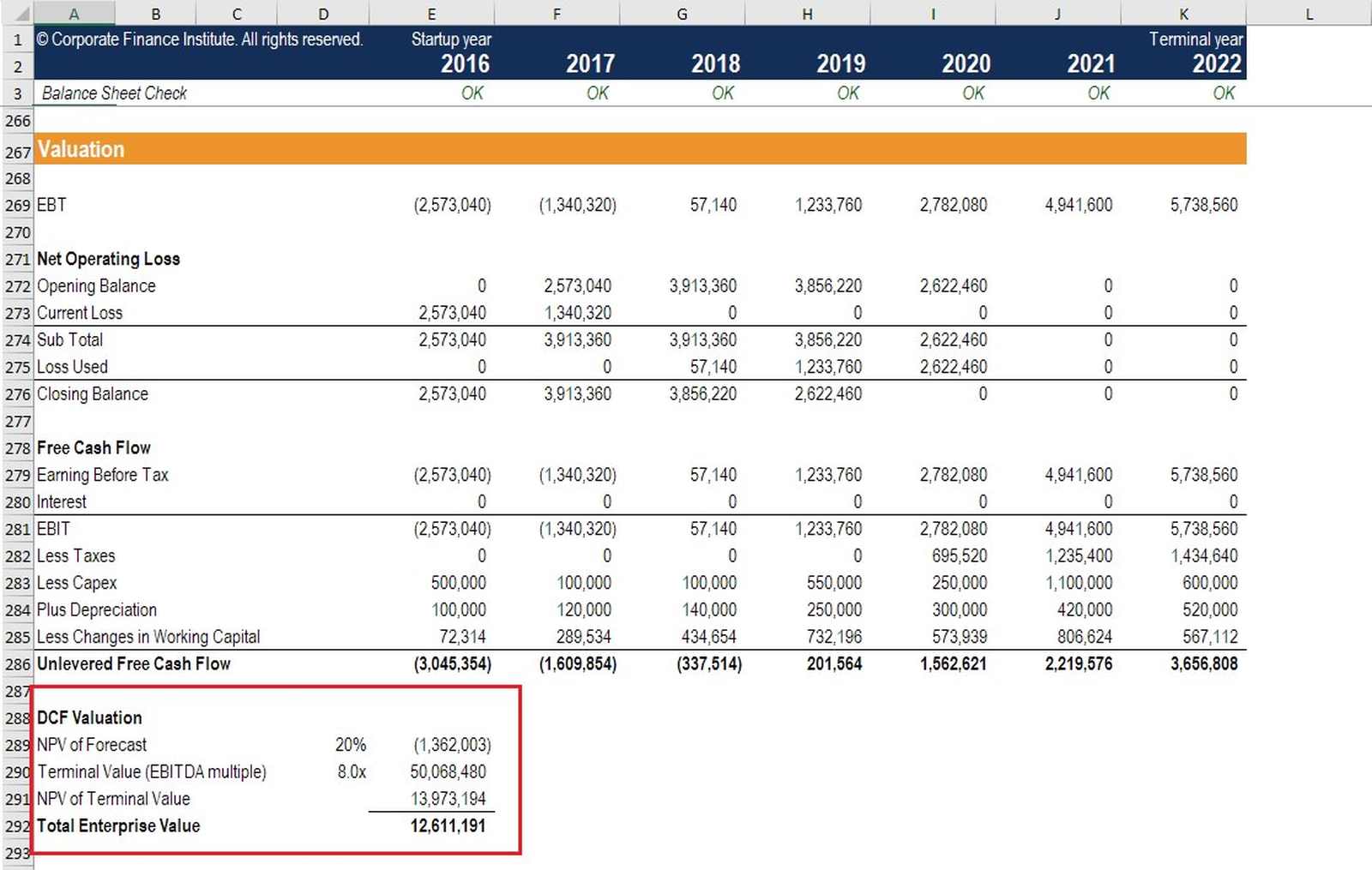

Look closely at the paradigm of the model beneath, and you will run into a line labeled "Less Changes in Working Capital" – this is where the bear upon of increases/decreases in accounts receivable, inventory, and accounts payable impact the unlevered free greenbacks menses of a firm.

Understanding the impact of changes in net working capital is extremely important in financial modeling and corporate valuation . To learn more than, check out CFI's financial modeling courses at present!

Boosted Resources

This has been CFI'due south guide to Net Working Capital. To advance your career as an annotator, read more than about the other elements that populate financial statements:

- Cadre Statements

- Income Statement

- Cash Flow Argument

- Financial Modeling Guide

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/what-is-net-working-capital/

0 Response to "if net fixed assets increased by $28,000 during the year, what was the addition to nwc"

Post a Comment